Irs rmd calculator 2021

You must take an RMD by April 1 of the next year after you celebrate your 72nd birthday. In addition once you do take the RMD youre responsible for federal income taxes on the 10000 RMD amount.

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates

An RMD in this situation would need to come out for 2021 no later than December 31 2021.

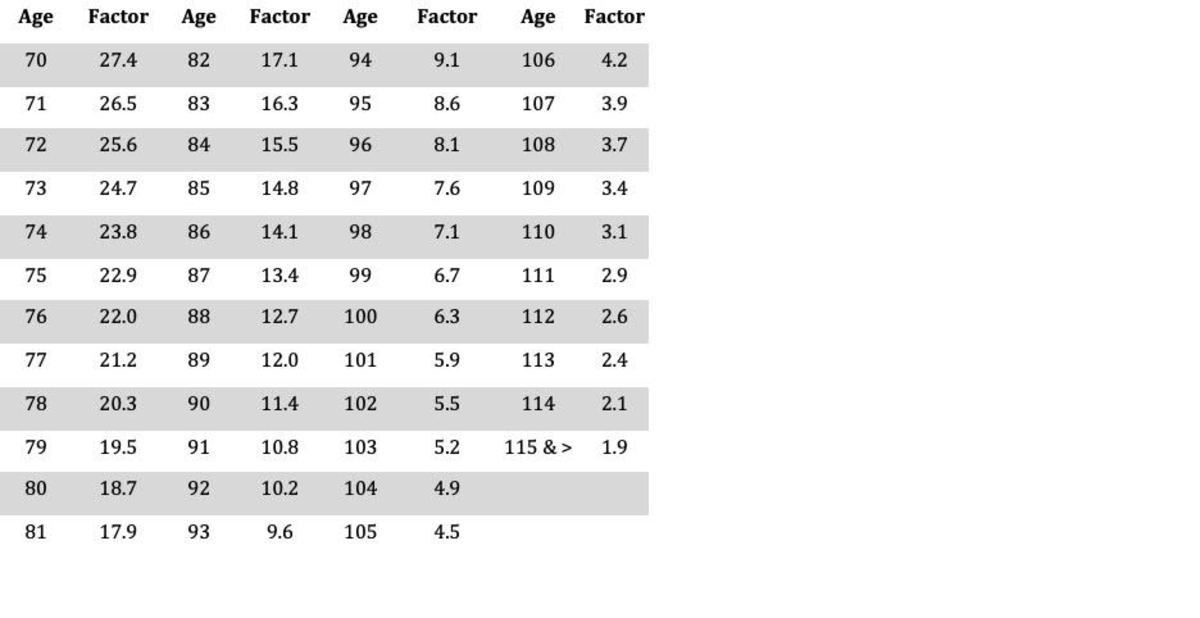

. For a 403b retirement plan the RMD is calculated separately but may be withdrawn from any of your 403b plan accounts. The official version of IRS Publication 590-B for the 2021 tax year includes the new life expectancy tables used to calculate RMDs from retirement accounts. This is your required minimum distribution for 2022.

The requirements to be a QCD are. A Roth IRA is different. Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors.

Call us at 866-855-5636. The distributions are required to start when you turn age 72 or 70 12 if you were born before 711949. However if the IRS paid you too much in monthly payments last year ie more than the child tax credit youre entitled to claim for 2021 you might have to pay back some of the money.

The distribution is from the pre-tax money in the IRA the one for whom the IRA is maintained is age 70½ or over the distribution is sent directly to the charity from the IRA. If you were born on or after 711949 your first RMD will be for the year you turn 72. If you dont take your RMD you could face a penalty of up to 50 of what the IRS says you should have withdrawn.

This is called aggregation and the IRS also permits it for 403b plans. If you were born on or after July 1 1949 your first would have been required by April 1 2021. If you have multiple IRAs you must calculate each account individually but you can take your total RMD amount from one IRA or a combination of IRAs.

Form 8915-F replaces Form 8915-E. Those who reached 72 in 2021 will have their first RMD due. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from some types of retirement accounts annually.

Form 8915-F Qualified Disaster Retirement Plan Distributions and Repayments replaces Form 8915-E for reporting qualified 2020 disaster distributions and repayments of those distributions made in 2021 and 2022 as applicableIn previous years distributions and repayments would be reported on the applicable Form 8915. You must coordinate the total annual distributions from your IRA accounts. Generally you dont have to worry about taxes on withdrawals from a Roth as long as the account has been open for five yearseven if youre taking RMDs from a beneficiary IRA.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. But there could be a way around RMD penalties. The IRS taxes these withdrawals in the year you take them.

However IRS guidance clarified that the April 1 2020 distribution has also been waived. The SECURE Act of 2019 changed the age that RMDs must begin. Use this calculator to determine your Required Minimum Distribution RMD.

Add up all tax-deferred retirement account balances as of 12312021. RMDs must be taken by age 72 if you were born after June 30 1949 or the pre-SECURE Act age 705 if you were born before July 1 1949. It helps to take the money before December 31 of the year you turn 72.

Whether or not the distribution is an RMD is not a factor in determining whether or not a distribution qualifies as a QCD. Find the number that corresponds to the age you will turn in 2021 from the table below. Money withdrawn from a traditional IRA will not count toward your 403b plan RMD and vice versa.

The April 1 extension only applies to the year after which you reach age 72. The same rule applies to your traditional IRAs. Any IRA monies converted into an immediate annuity are not subject to RMD penalties.

How To Determine And Take Your Rmd Richard A Hall Pc

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Mandatory Ira Withdrawals The Elder Law Firm Of Robert Clofine

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

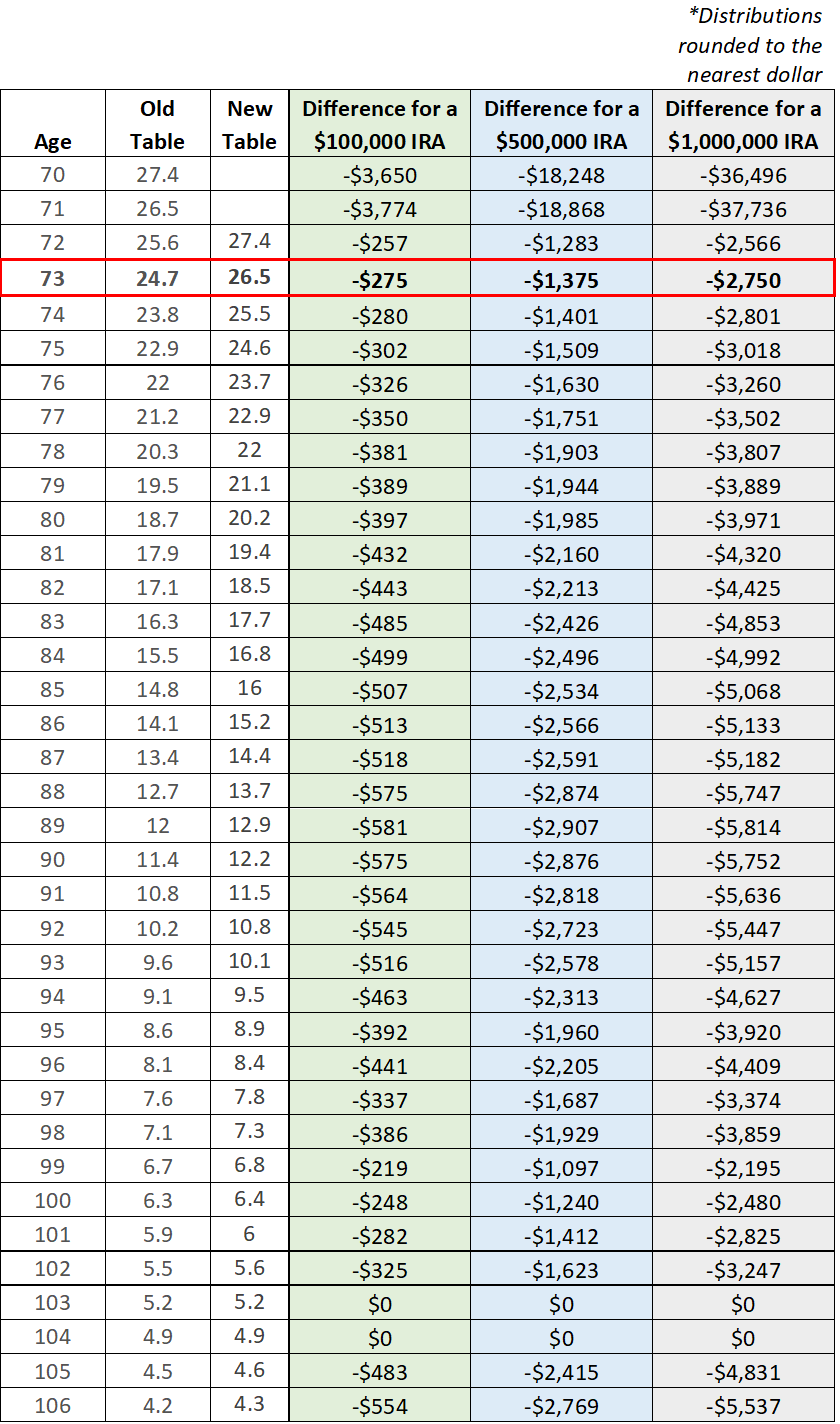

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Calculating Required Minimum Distributions

Rmd Table Rules Requirements By Account Type

Required Minimum Distributions Update 2021 Fcmm Benefits Retirement

Required Minimum Distributions Rmds Are You Ready

Where Are Those New Rmd Tables For 2022

What Do The New Irs Life Expectancy Tables Mean To You Glassman Wealth Services

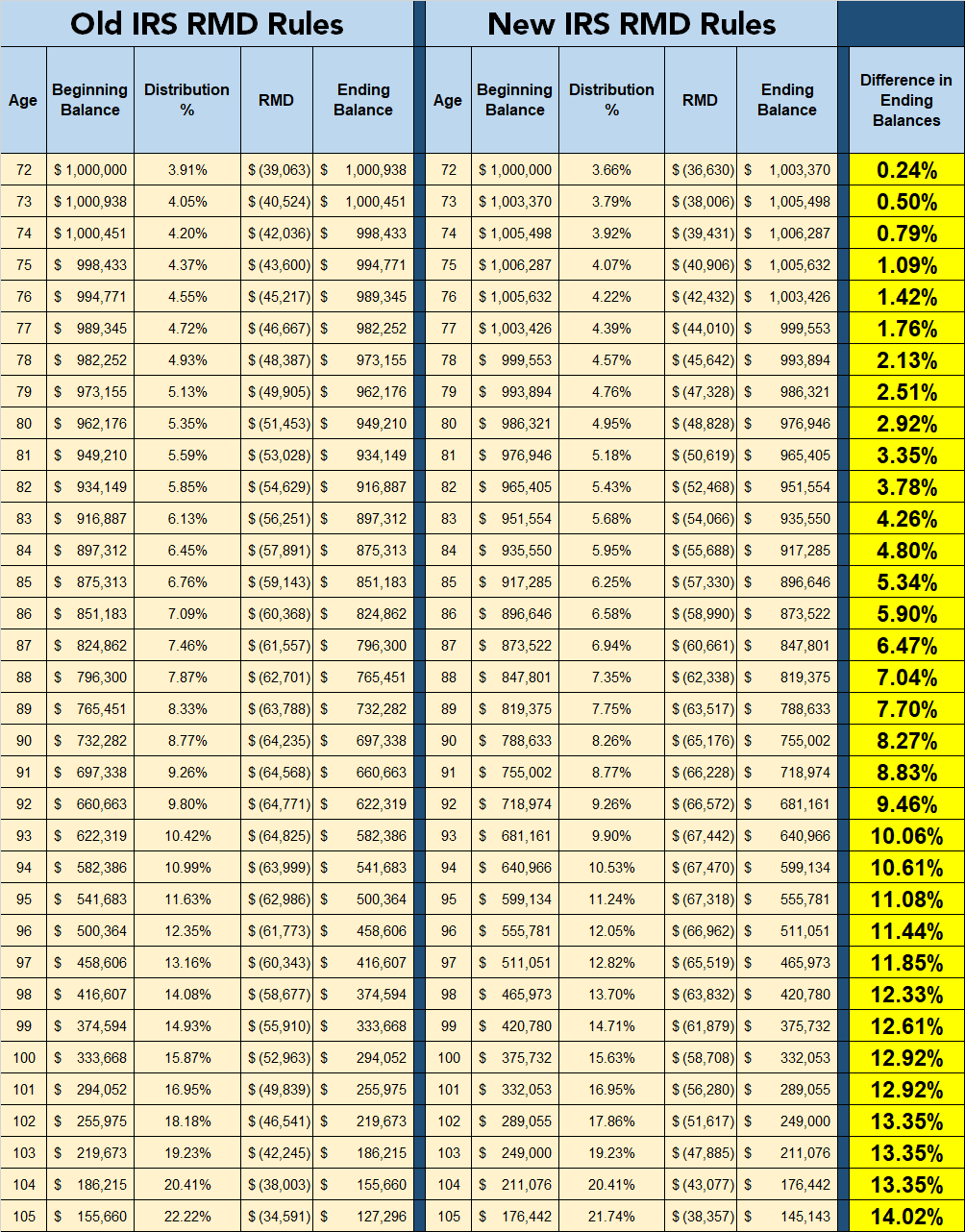

Irs Change Will Decrease Rmds Beginning In 2022 Level Financial Advisors

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Required Minimum Distributions For Retirement Morgan Stanley

The Tax Impact Of The Long Term Capital Gains Bump Zone Capital Gain Capital Gains Tax Tax

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management